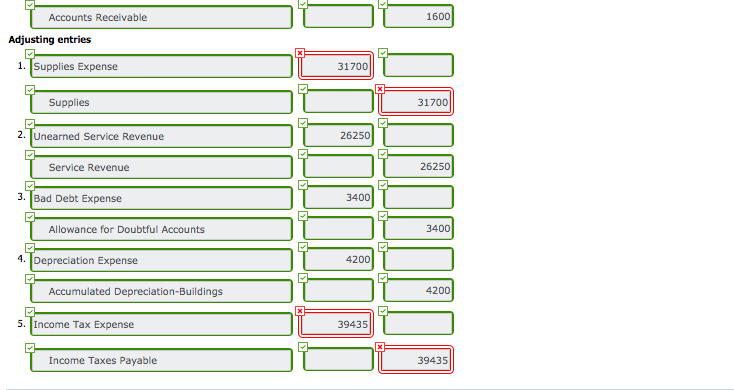

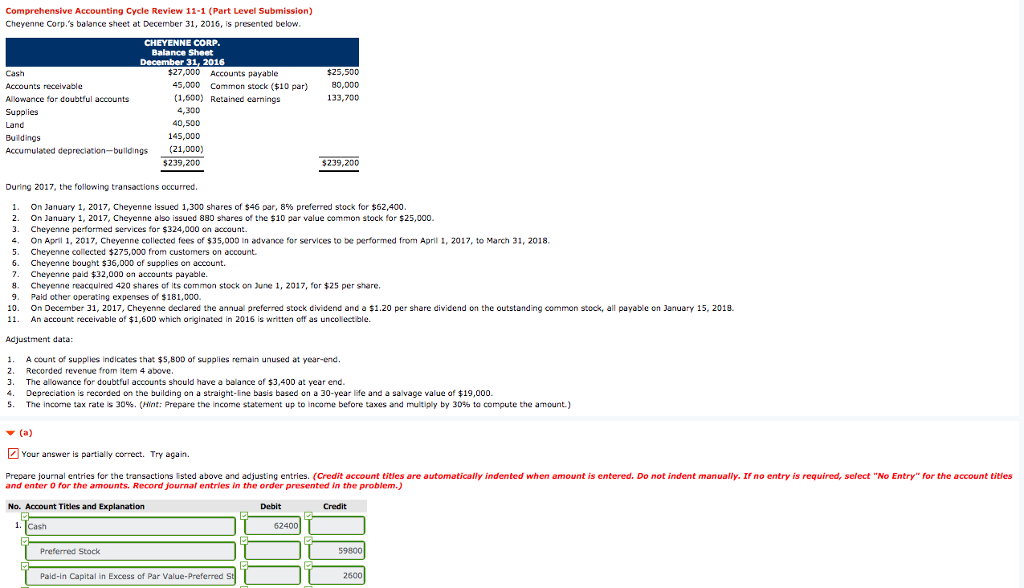

Accounting Worksheet Total Decmeber 31, 2017 Adjustments

Prepaid Rent still in force at December 31 2900. Make adjusting entries for each of these transactions using the appropriate Excel functions.

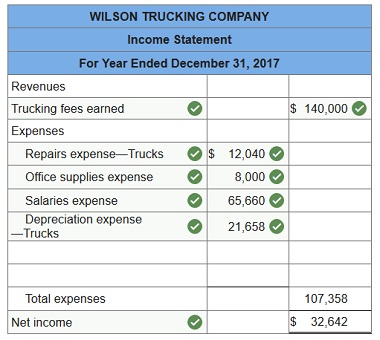

Income Statement Problems Cost Of Goods Sold Net Income

The total amount of accrued Interest expense at year-end is 8000.

Accounting worksheet total decmeber 31, 2017 adjustments. Elis Consulting Services Worksheet Month Ended December 31 2019. Midnight on December 31 2017. Adjust the inventory balance and close out the purchase and related accounts to cost of sales.

The cost basis of the inventory on hand is 19196700. The unadjusted trial balance as of December 31. WAREN SPORTS SUPPLY YEAR-END WORKSHEET DECEMBER 31 2013 Student Name__Craig Stenberg _____ TRANSACTIONS LIST A Instructor____Day_____Date Due_ Slideshare uses cookies to improve functionality and performance and to.

Discover learning games guided lessons and other interactive activities for children. The companys fiscal year-end is December 31. C What consolidation worksheet adjustments would have been required as of December 31 2013 to account for the intra-entity sale of fixed assets.

Ad Download over 20000 K-8 worksheets covering math reading social studies and more. On December 31 the adjusted trial balance of Shihata Employment Agency shows the following selected data. Unpaid Salaries during the 2008 was Rs.

Pastina Company sells various types of pasta to grocery chains as private label brands. Record the adjusting entry on Dec 31 for insurance expired. O 60 employees with a daily pay of 5700.

The cost of unused office supplies still avalable at year-end is 900. Use the above Information about the companys adjustments to complete a 10-column work sheet. Last pay period ended December 27.

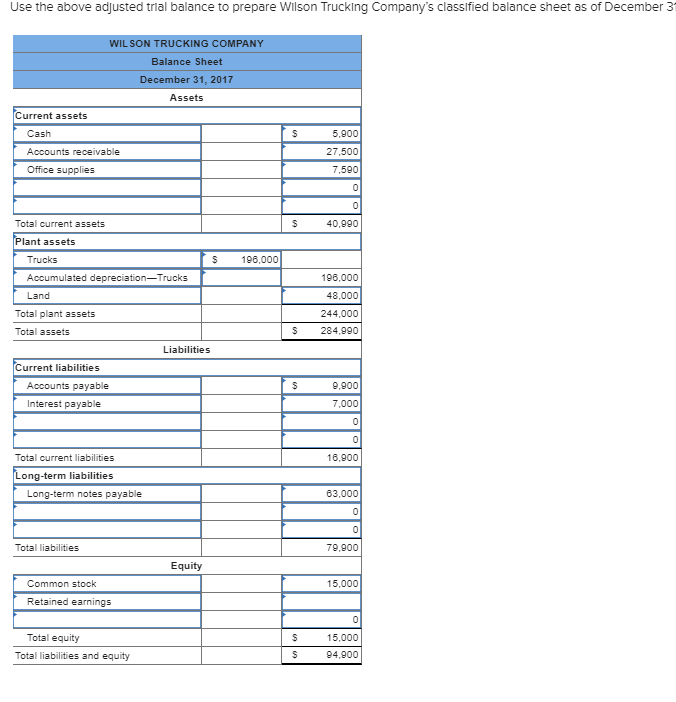

Compute the equity method balance in Corgans Investment in Smashing Inc account as of December 31 2018. The accounting equation is balanced as shown on the balance sheet because total assets equal 29965 as do the total liabilities and stockholders equity. Waren Sports purchased a new Ford F-150 truck for 30000 on December 21 2017.

As of December 31 there are 10640 unpaid labor hours already worked at an average hourly rate of 34. Enter the general ledger account names. Discover learning games guided lessons and other interactive activities for children.

Terms are 75 annual rate interest only until due date. Accounts Receivable24500Service Revenue92500 Interest Expense7700Interest Payable2200 Analysis shows that adjusting entries were made to. 300 paid for two years first year had expired.

D Assume that consolidated financial statements are being prepared for the year ending December 31 2014. Completing the Accounting Cycle. We will need to add four new accounts at this time so that we can make adjustments at.

The first step is to enter the general ledger account names. Worksheet 3 GENERAL JOURNAL Date Accounts Debit Credit Dec. The auditors found 2 transactions that were not recorded at December 31 2017.

Section 1 Objective 5-1. Stock at 31 st December was valued at Rs. There is a worksheet approach a company may use to make sure end-of-period adjustments translate to the correct financial statements.

See pages 77-79 in the SUA Reference Manual 5. At the end of 2017 and 2018 40 percent of the current year purchases remain in Smashings inventory. Unearned Revenue still unearned at December 31 3000.

4 The company estimates that utilities used during December for which bills will be received in January amount to 40000. The auditors found 2 transactions that were not recorded at December 31 2017. Prepare the worksheet adjustments for the December 31 2018 consolidation of Corgan and Smashing.

600012 500 per month May to Dec 8 months x 500 4000 expired Insurance expense 4000 Prepaid insurance 4000 2017 Mr. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. General Expenses of Rs.

O 6 interest note payable was made on January 31 2017 and is due February 1 2019. A Debt of Rs. 100 is to be written off as bad by direct method.

All receive pay through December 31. Office Supplies used 1600. O 5-year loan was made on June 1 2017.

Pay period is every 2 weeks. Prepare the year-end closing entries for Dylan Delivery Company as of December 31 2017. The unadjusted trial balance of Walsh Anvils at December 31 2016 and the data for the adjustments follow.

Intermediate Accounting Solution March 2016

Intermediate Accounting Solution March 2016

Prepare A Retained Earnings Statement For The Year Chegg Com

Ch17 Kieso Intermediate Accounting Solution Manual

Connect Financial Accounting Chapter 3 Ask Assignment Help

Solved Problem 7 The Accounts Below Appeared In The Dec 31 2020 Trial Balance Of The Ceradoy Corporation Ordinary Shares P15 Par 20 000 Share Course Hero

The Following Information Applies To The Questions Chegg Com

Cfas Pfa And Tfa Retained Earnings Debits And Credits

Chapter 7 Retained Earnings Treasury Stock

Prepare A Retained Earnings Statement For The Year Chegg Com

Accounting Principles 12th Edition Ch1

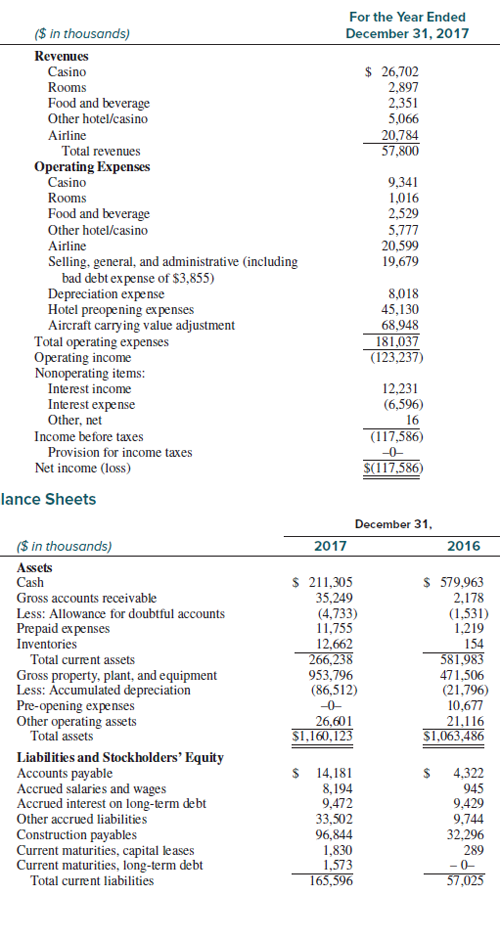

The Income Statement For The Year Ended December 31 2017 Chegg Com

Lq 1 Set A Solution Bonds Finance Accounts Payable

Ch17 Kieso Intermediate Accounting Solution Manual

Intermediate Accounting Solution March 2016

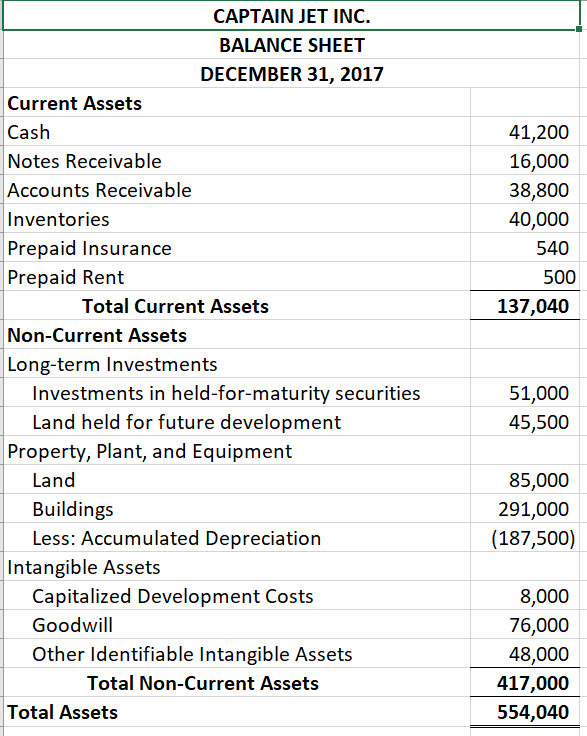

Captain Jet Inc Balance Sheet December 31 2017 Chegg Com

Intermediate Accounting Solution March 2016