When Doing Accounting Worksheet Adjustment Which Goes On Top Debits Over Credits

If the sum of the debit entries in a trial balance in this case 36660 doesnt equal the sum of the credits also 36660 that means theres been an error in either the recording of the journal entries. After posting the above entries they will now appear in the adjusted trial balance.

Adjusting Entries Deferral Debits And Credits

What does that mean.

When doing accounting worksheet adjustment which goes on top debits over credits. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. On the other side of the T you place your credits. Service Supplies is credited for 900.

And on the top of the T you usually name the item you are debiting or crediting as shown. Paid Salary to Employees by check. Big advantage of this method is that it leaves no room for an error as soon as you learn it you will be able to get it right all the time.

When a business firm owes wages to employees at the end of an accounting period they make an adjusting entry by debiting wage expenses and crediting wages payable. Debits dr record all of the money flowing into an account while credits cr record all of the money flowing out of an account. Debit The withdrawal of cash by the owner for personal use is placed on a temporary drawings account and reduces the owners equity.

The title of the account will appear at the top of each T. Debits and credits final thoughts. Since every transaction will involve at least two accounts we recommend that you always begin by drawing two T-accounts.

Accounting for inventories can be complicated with specific rules for debits and credits affecting various accounts. Unearned revenues refer to payments for goods to be delivered in the future or services to be performed. The rules for inventory accounting in the United States are governed by.

Discover learning games guided lessons and other interactive activities for children. Adjusting Entries at period end- Correct improper account ledger balances. It is not an expense of the business.

Under this system your entire business is organized into individual accounts. Trial Balance Preparation- Take the Ending Balance from each Accounts Ledger and note if it is a Credit or Debit Balance. Cash Debit Asset is Increasing Bank Account Credit Asset in Bank decrease Example 8.

If you use accounting software this usually means youve made a. This is probably the most comprehensive method. Service Supplies Expense is debited for 900.

This method utilises your special memory the strongest. Fortunately computerized accounting systems help in this process minimizing errors while automatically performing many tasks. What are debits and credits.

Debit amounts will be entered on the left side of the T-account and credit amounts will be entered on the right side. See 10 Tips for Studying Accounting. Discover learning games guided lessons and other interactive activities for children.

Drawing debit Debit the receiver Bank Account Credit Asset in bank decrease Example 9. Use the DEALER method and you will do well. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Withdraw amount from bank for office use. Drawings Accounting Bookkeeping Entries Explained. Enter in Unadjusted Trial Balance column of Accounting Worksheet.

Credit Cash is withdrawn from the business and taken by the owner. The Service Supplies account had a debit balance of 1500. BS and PL Method.

In this representation you draw a big capital letter T on a paper and on one side of the T you place your debits. However these are rules that you need to memorize. After incorporating the 900 credit adjustment the balance will now be 600 debit.

Withdraw amount from bank for personal use. Debits are always on the left side of the entry while credits are always on the right side and your debits and credits should always equal each other in order for your accounts to remain in. Think of these as individual buckets full of.

Finally here is a way to remember the DEALER rules. Accounting is the language of business and it is difficult. When you start to learn accounting debits and credits are confusing.

Most businesses these days use the double-entry method for their accounting.

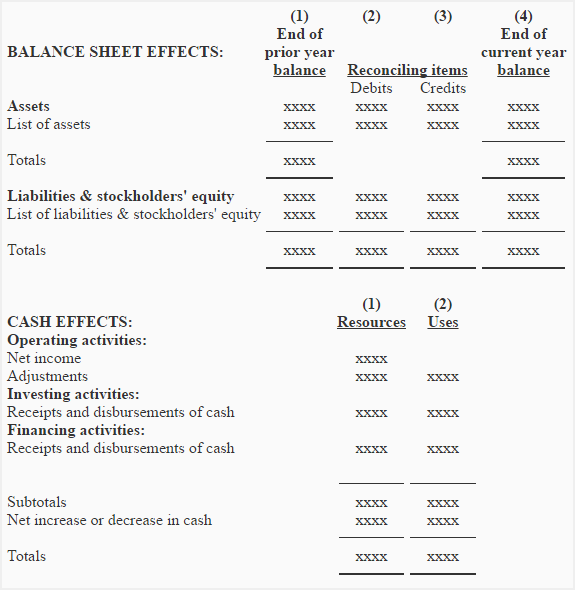

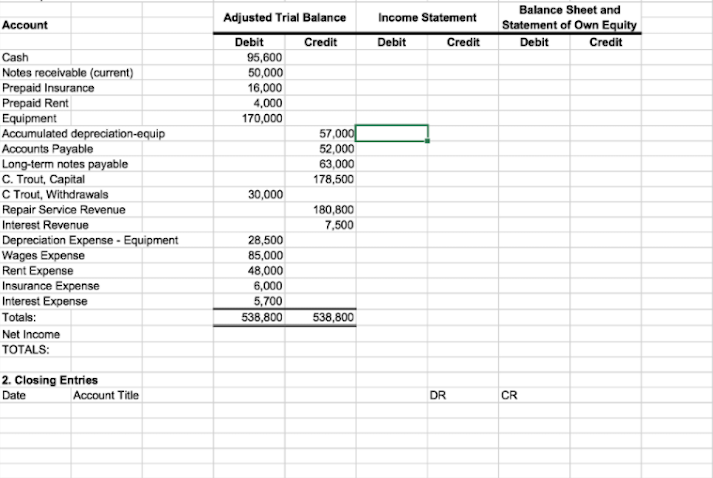

Worksheet For Preparing A Statement Of Cash Flows Accounting For Management

Chapter 4 Completing The Accounting Cycle Debits And Credits Expense

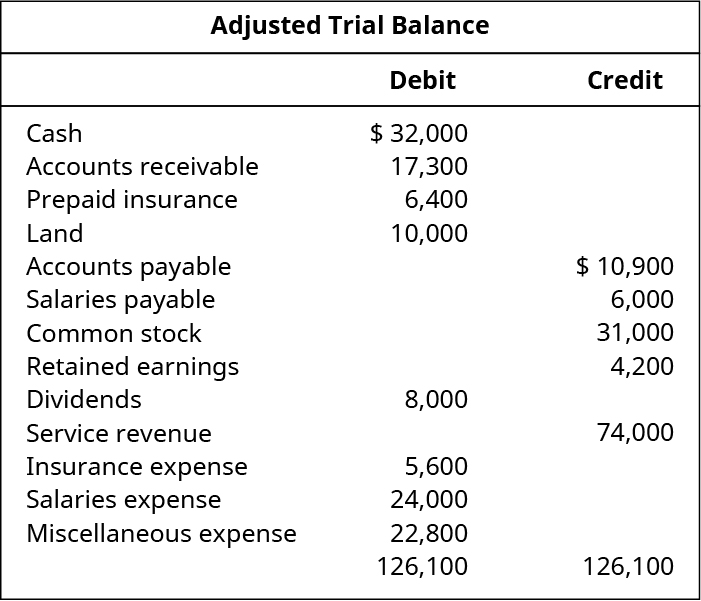

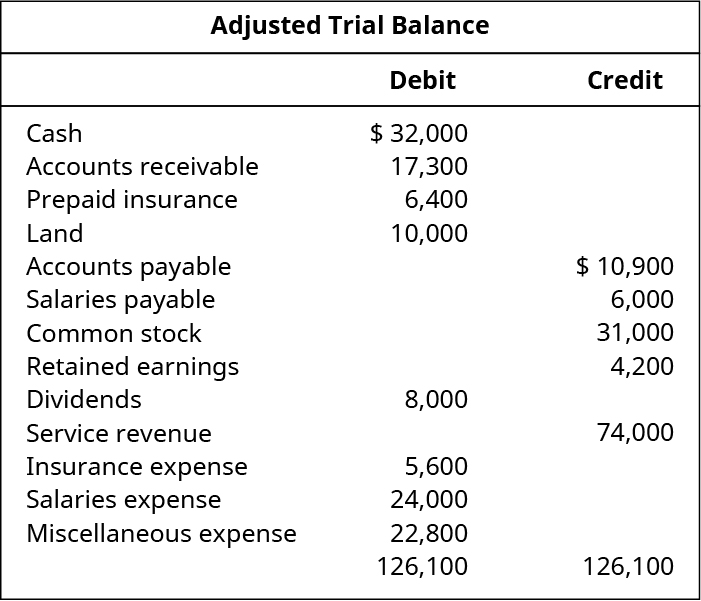

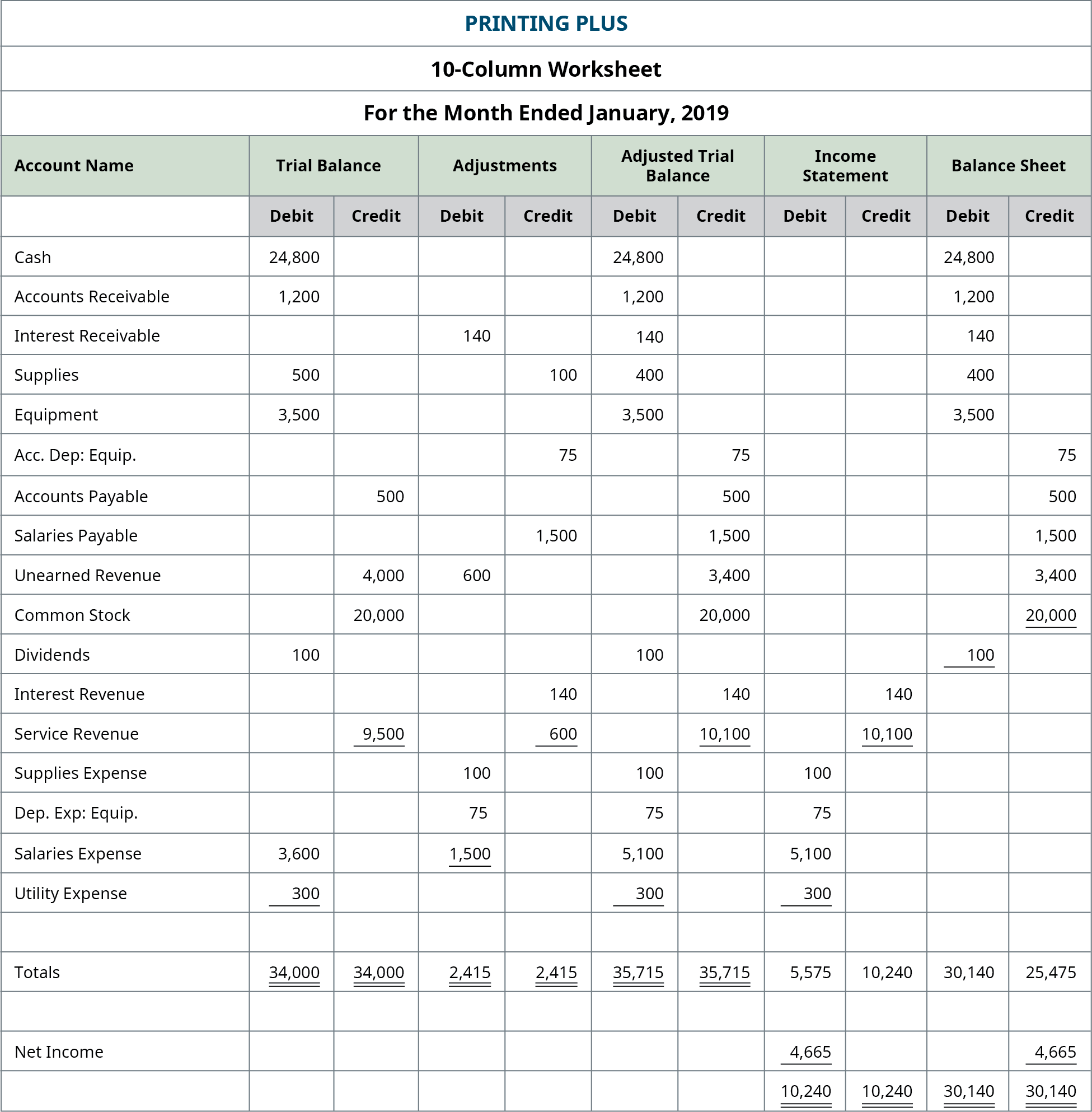

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

4 5 Prepare Financial Statements Using The Adjusted Trial Balance Business Libretexts

Accounting An Introduction 2013

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Chapter 4 Completing The Accounting Cycle

4 5 Prepare Financial Statements Using The Adjusted Trial Balance Business Libretexts

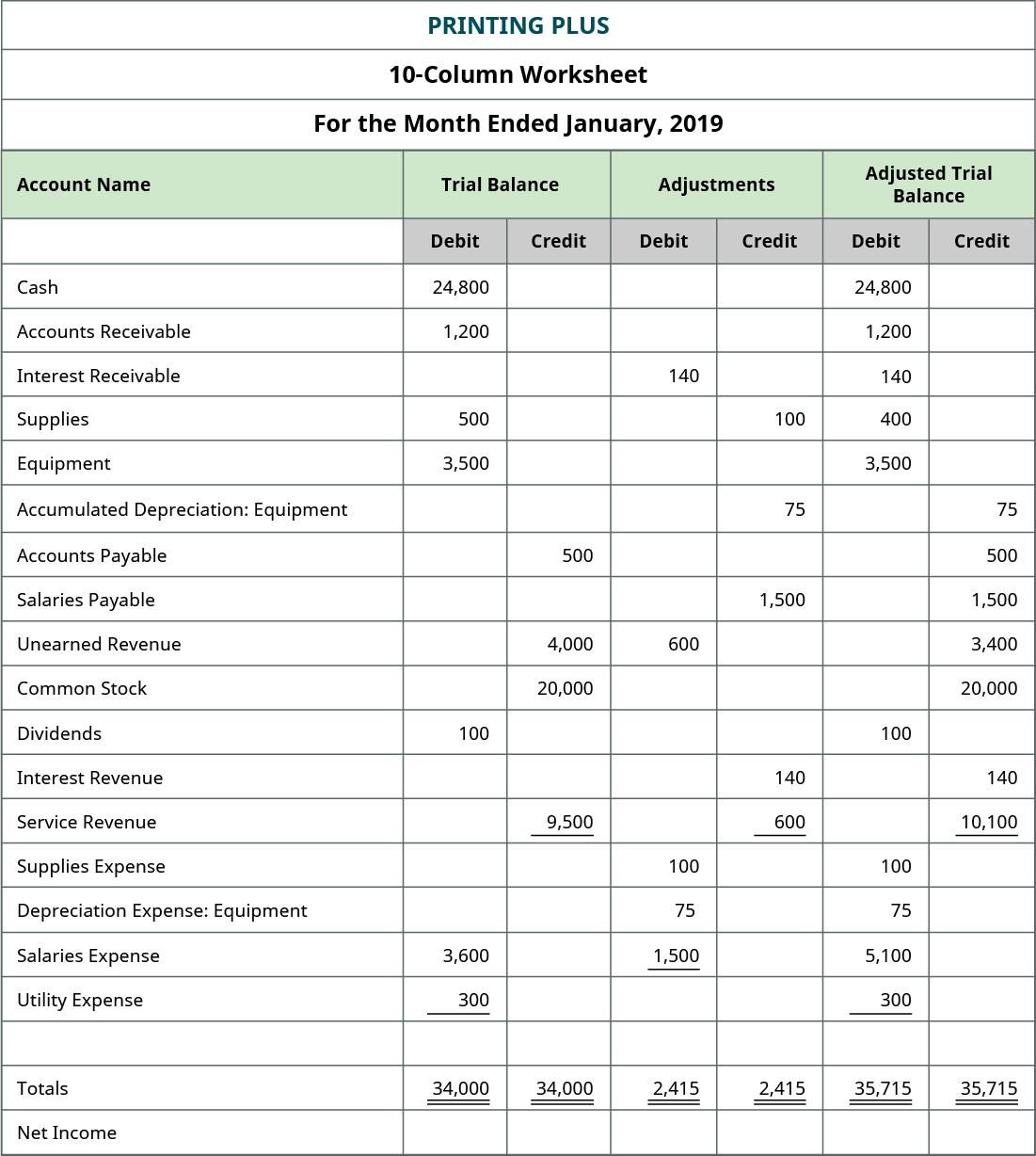

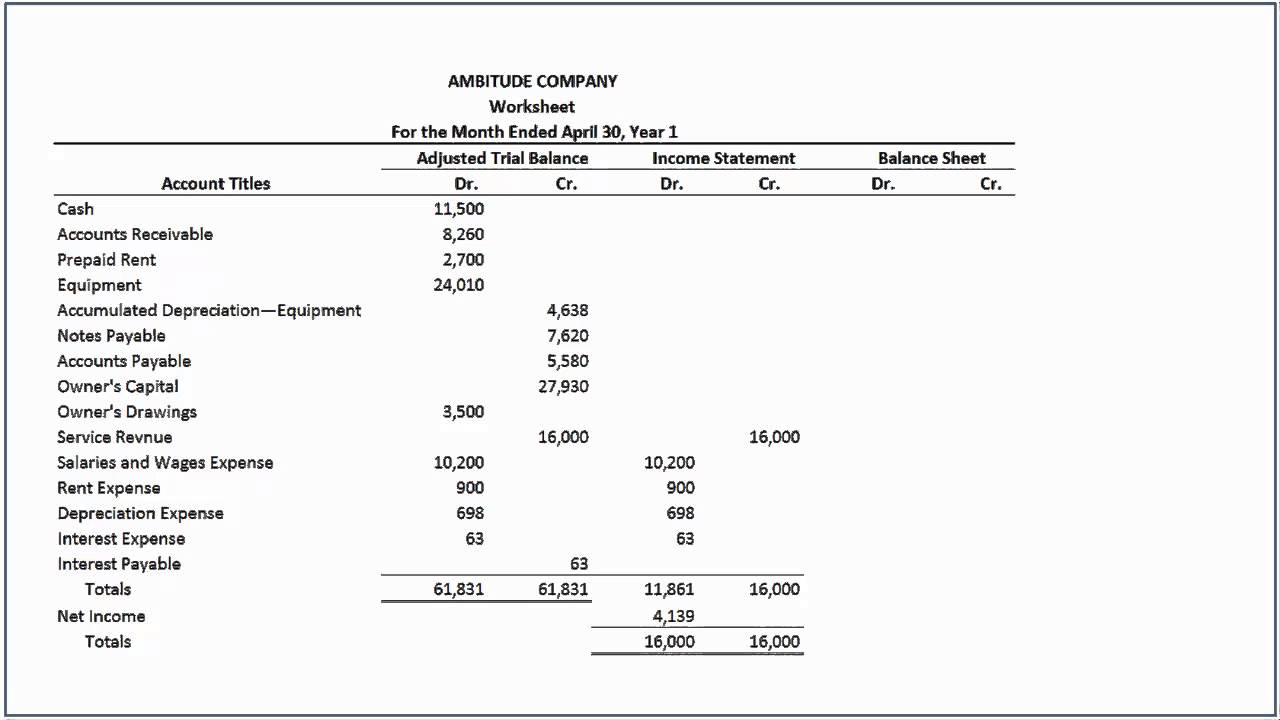

How To Complete The Worksheet Accounting Principles Youtube

Balance Sheet Example Accountingcoach

A Beginner S Guide To The Post Closing Trial Balance The Blueprint

Chapter 5 Adjustments And The Worksheet Smccd Pages 1 6 Flip Pdf Download Fliphtml5

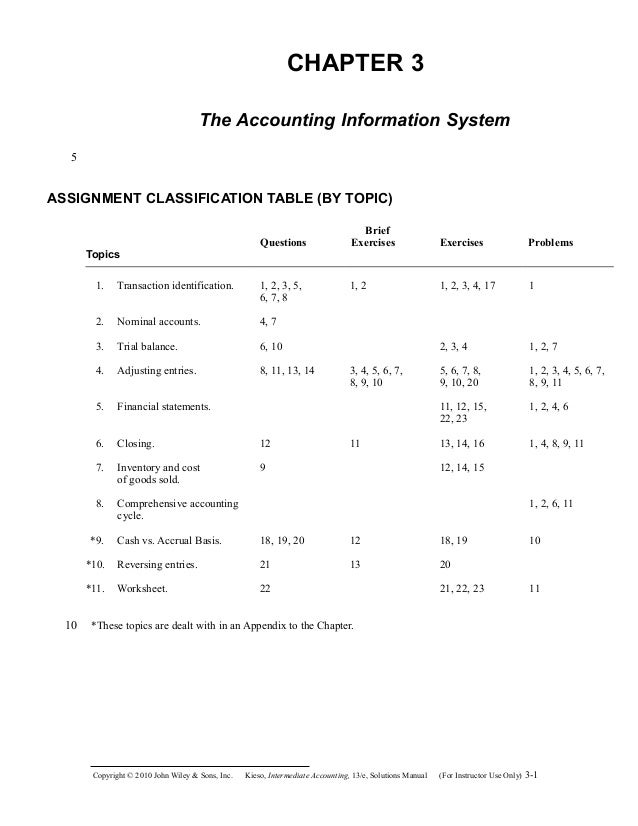

Ch03 Kieso Intermediate Accounting Solution Manual

4 5 Prepare Financial Statements Using The Adjusted Trial Balance Business Libretexts

Unadjusted Trial Balance Format Preparation Example

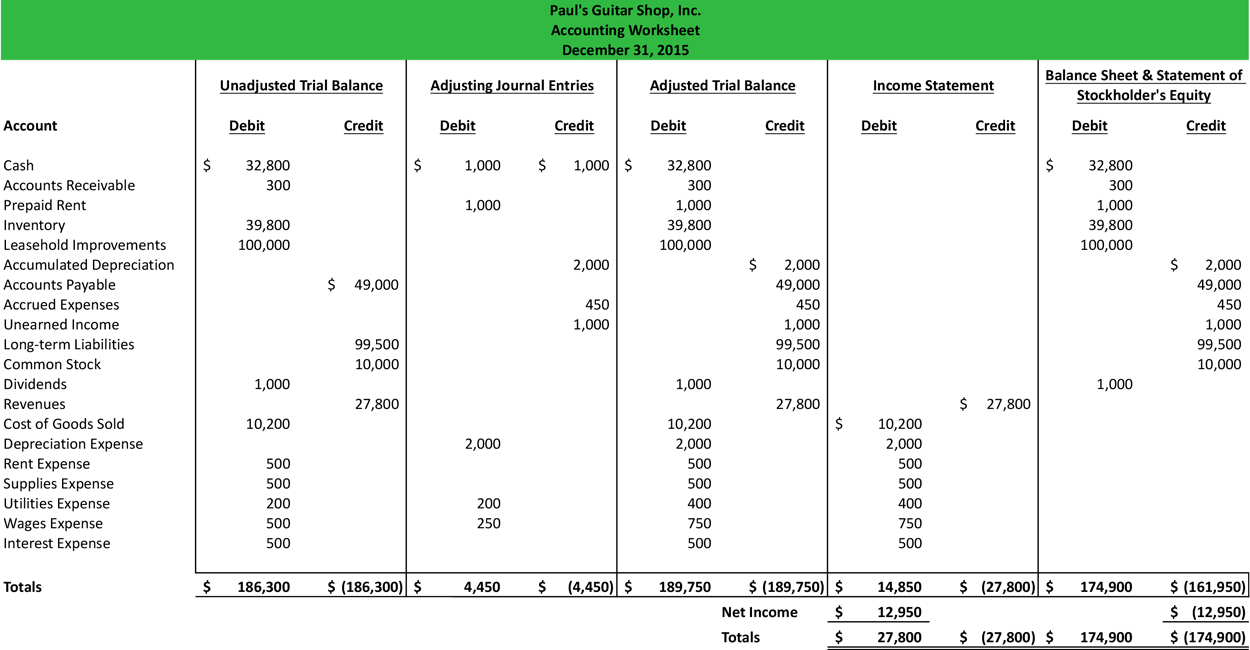

Accounting Worksheet Format Example Explanation

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting